The American Rescue Plan Act of 2021: What Investors Need to Know

It’s official. President Biden signed the American Rescue Plan Act of 2021 into law on March 11th, 2021, making the near $1.9 trillion stimulus package the largest injection of federal aid since the Great Depression.¹

While there’s a lot in this bill, key provisions include direct payments to Americans, expanded child tax credits, and healthcare relief.

Keep reading below to see exactly how this legislation affects you and your family.

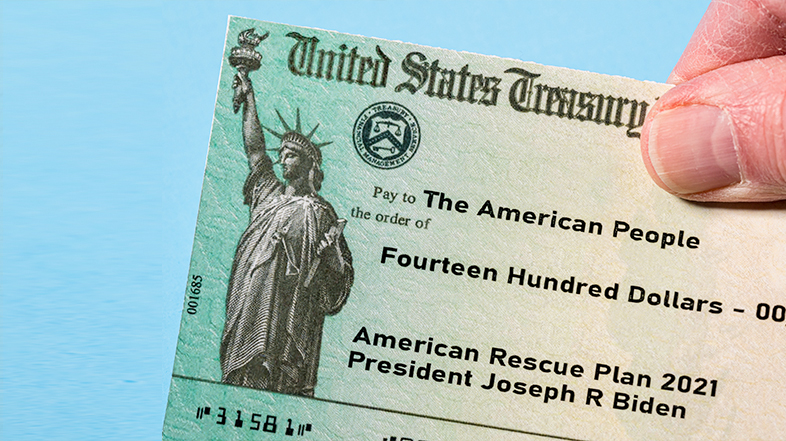

Stimulus Checks

Full $1,400 payments will go to individuals whose adjusted gross income (AIG) is up to $75,000, heads of household with AIG up to $112,500, and $150,000 AIG for married couples filing jointly.

Payments are reduced for Americans with incomes above these thresholds and phase out to zero for individuals earning $80,000 in income, heads of household with $120,000, and married couples filing jointly with $160,000.

Unlike the other two stimulus payments, if you are eligible, then your dependents will qualify for the $1,400.

Should you qualify and have a 20-year-old college student living with you or an elderly parent or grandparent, your dependents will also receive a $1,400 check.

Based on the last round of checks the IRS sent, Americans who qualify should start receiving checks in about 2 weeks, or before the end of March.²

Child Tax Credit Updated

The American Rescue Plan expands the existing Child Tax Credit for 2021 from $2,000 per dependent to $3,000 per child ages 7 to 17 and $3,600 per child under age 6.

To qualify, the child must have a Social Security number and live with you for at least 6 months during the filing year.

Phaseouts start for individuals earning more than $75,000, $112,500 for head-of-household returns, and $150,000 for married filing jointly.

This means families who aren’t eligible can claim the regular credit of $2,000 per child, less the amount of any monthly payments they got. And providing their AGI is below the current thresholds of $400,000 on joint returns and $200,000 on other returns.

AGI will be determined by 2019 or 2020 tax fillings.

Under the American Rescue Plan, parents do not have to wait to file their taxes and claim the tax credit to see relief.

The amount you will receive monthly is based on half your 2021 child tax credit.

However, from July 2021 to December 2021, the IRS will mail monthly payments to qualifying parents – up to $250 per child and $300 per child under age 6.

That means if you have 1 child age 3 and 2 kids between 7 and 17, your estimated monthly payments from July to December 2021 will be $800.

The estimated credit you can claim on your 2021 tax return would be $4,800.

Health Insurance Assistance

Under the new bill, workers who lose employer healthcare coverage can keep their group health coverage through September 30, 2021.

This provision provides a tax credit employers can use to pay to keep coverage for departing employees through COBRA.

This means that employees will not have to pay anything out of pocket for their health insurance from April 1 to September 30. 100% of COBRA premiums will be covered.

Benefits end if you voluntarily leave your job or if you get a new job with health coverage.

Typically, COBRA allows a worker who loses his/her job to purchase coverage through the former employer after termination.

And it isn’t cheap.

The average cost to have COBRA is more than $1,500 per month.

Another provision in the American Rescue Plan allows for an increase in subsidies used to pay for health coverage purchased through the Affordable Care Act public exchange system.

These include:

- For those unemployed: For those out of work who apply for exchange plan coverage, this provision allows for them as if their income was 133% of the federal poverty level. This provision could reduce ACA exchange out-of-pocket costs to close to zero.

- For higher-income earners: This tax credit provision will help people pay for exchange plan coverage by capping payment for coverage at 8.5% of their AIG (adjusted gross income). The government would make up the difference between 8.5% of a person’s income and the cost of coverage.

How to Make Your Stimulus Check Work for You

If you have a 401(k), consider investing your stimulus money in your financial future.

It’s an easy way to boost retirement savings without reducing your take-home pay or having to cut back on monthly expenses.

If you invest your stimulus money into your 401(k), it needs to go through payroll deduction.

We recommend you contact your Human Resources department, tell them the amount you want to invest, and they will take it out of your paycheck(s).

Then use your stimulus to live on and make up the difference during this time.

If you have an IRA, we recommend you do the same.

Additionally, if you qualify for the child tax credit, consider setting up a 529 plan to save for your kid’s college, graduate school, or K-12 tuition.

As long as you use the money for qualified education expenses, you won’t have to pay additional taxes on the money saved.

We regularly post videos with financial information and updates. Check us out on YouTube.

Sources:

- https://www.cnn.com/politics/live-news/stimulus-house-vote-03-10-21/index.html

- https://www.cbsnews.com/news/third-stimulus-check-when-get-1400-2021-03-10/